Tesla paid no federal income taxes while paying executives $2.5 billion over five years

Elon Musk’s company earned $4.4 billion during those five years and gave its executives $2.5 billion. Despite that, Tesla not only didn’t pay any federal taxes, but it received $1 million in refunds from the government. Musk himself is the second richest person in the world, with Forbes reporting he had a net worth of $207.9 billion at the start of March.

Tesla is one of 35 companies that paid less federal income tax than they paid their top five executives during that period.

Scheerpost: China Is ‘World’s Sole Manufacturing Superpower’, With 35% of Global Output

CNBC: ‘Excess profits’ at big energy and consumer companies pushed up inflation, report claims

34% of Big, Profitable US Corporations Paid $0 in Federal Taxes in 1st Year of Trump Tax Law

ProPublica: If You’re Getting a W-2, You’re a Sucker “There are many differences between the rich and the rest of us, but one of the most consequential for your taxes is whether most of your income comes from wages.” The article describes some of the ways that rich people avoid paying taxes, despite earning massive fortunes.

Scientific American: For Billion-Dollar COVID Vaccines, Basic Government-Funded Science Laid the Groundwork Much of the pioneering work on mRNA vaccines was done with government money, though drugmakers could walk away with big profits.

Texas team gives away 90% effective patent-free covid vaccine “While Big Pharma corporations took billions of dollars in public funding to help develop vaccines from which they then reaped enormous profits while often charging exorbitant prices, Hotez and Battazzi created Cobervax with $7 million, mostly from private investors. One of these, Austin vodka distiller Tito’s, contributed $1 million to the effort.”

NY Times: Hospitals and Insurers Didn’t Want You to See These Prices. Here’s Why.

If you’re so smart, why aren’t you rich? Turns out it’s just chance.

Outrage at ProPublica Tax Leaks Underscores Their Importance The wealthiest “can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.”

No Federal Taxes for Dozens of Big, Profitable Companies “FedEx and Nike are among those found to have avoided U.S. tax liability for three straight years.”

CBS News: 50 years of tax cuts for the rich failed to trickle down, economics study says

FastCompany.com: ‘We were shocked’: RAND study uncovers massive income shift to the top 1% “The median worker should be making as much as $102,000 annually—if some $2.5 trillion wasn’t being “reverse distributed†every year away from the working class.”

Fifty Years of Tax Cuts for Rich Didn’t Trickle Down, Study Says “Tax cuts for rich people breed inequality without providing much of a boon to anyone else, according to a study of the advanced world that could add to the case for the wealthy to bear more of the cost of the coronavirus pandemic.”

How a New Hampshire libertarian utopia was foiled by bears and by ideological extremism.

Republicans, Not Biden, Are About to Raise Your Taxes “People making from $10,000 and $30,000 — nearly one-quarter of Americans — are among millions slated to pay more in 2021. They surmised — correctly, so far — that if they waited to add the tax increases until after the 2020 election, few of the people most affected were likely to remember who was responsible.”

Business Insider: The wealthiest 1% has taken $50 trillion from working Americans and redistributed it, a new study finds. Here’s what that means. “Each year, $2.5 trillion — yes, trillion with a “T” — has been redistributed from the bottom 90% of Americans to the wealthiest 1 % of all Americans.”

On eve of bankruptcy, U.S. firms shower execs with bonuses

The Wealthy Can’t Stop Not Paying Their Taxes

David Sirota: The One Percent Are Cheating Us Out of a Quarter-Trillion Dollars in Taxes Every Year

“The Federal Reserve created $3.267 trillion out of thin air in a few months; that’s $22,600 for every taxpayer in the USA. Your share is at most $1200. The other $21,400 created out of thin air went to corporations, monopolies, and other financial parasites and predators.” – Charles Hugh Smith

Tax Fraud Is An Earned Benefit For The Wealthy “Many people in this country clearly believe that being in the position to finagle your taxes, like the having the chance to cheat on your wife with porn stars and supermodels, is an earned privilege.”

The IRS Decided to Get Tough Against Microsoft. Microsoft Got Tougher. “For years, the company has moved billions in profits to Puerto Rico to avoid taxes. When the IRS pushed it to pay, Microsoft protested that the agency wasn’t being nice. Then it aggressively fought back in court, lobbied Congress and changed the law.”

“Between 1980 and 2018 … the tax obligations of America’s billionaires, measured as a percentage of their wealth, have fallen 79 percent.” (source)

Warren Buffett on the US economy: ‘The tsunami of wealth didn’t trickle down. It surged upward’ “He points to the Forbes 400, which lists the wealthiest Americans. “Between the first computation in 1982 and today, the wealth of the 400 increased 29-fold — from $93 billion to $2.7 trillion — while many millions of hardworking citizens remained stuck on an economic treadmill.”

PolitiFact says it’s mostly true: “The top 0.1 percent … own about the same wealth as 90 percent of America.”

NPR: Coronavirus Relief Bill Challenges All That Libertarians Believe In

More socialism for the rich: Stimulus Bill Allows Federal Reserve to Conduct Meetings in Secret; Gives Fed $454 Billion Slush Fund for Wall Street Bailouts Like the 2008 recession, the covid-19 crisis shows the utter falsity of libertarian attacks on government. Then, like now, government came to the rescue of corporations and Wall Street.

Bill Gates’s Charity Paradox About Bill Gates’ tax dodging and philanthropy, which often benefits himself and for-profit corporations.

300 economists tell world leaders tax havens ‘serve no useful economic purpose’

Banks pressure health care firms to raise prices on critical drugs, medical supplies for coronavirus

‘Freedom payments?’ The coronavirus exposes the fraud of the anti-government movement. “The stated premise of the Tax Cuts and Jobs Act of 2017 was to goose the economy, which it didn’t do (annual growth was exactly the same in the two years prior to passage as in the two years after — 2.4%). So it didn’t make America stronger. What it did was weaken the federal government, by looting the treasury to feather the nests mostly of corporations and the already rich. This withering of the government has always been part of the point. But where are the adherents of this now — now that we’re in trouble? They’re clamoring for their own freedom payments.” To bailout corporations and Wall Street.

Finland, a social democracy, is the happiest country for 2020

Public Health Experts: Single-Payer Systems Coping With Coronavirus More Effectively Than For-Profit Model “Having a healthcare system that’s a public strategic asset rather than a business run for profit allows for a degree of coordination and optimal use of resources.”

The Dismantled State Takes on a Pandemic “Conservatives won their war on Big Government. Their prize is a pandemic.”

Oxfam International: The 1% grabbed 82% of all wealth created in 2017

Medical Journal the Lancet: Improving the prognosis of health care in the USA

[W]e calculate that a single-payer, universal health-care system is likely to lead to a 13% savings in national health-care expenditure, equivalent to more than US$450 billion annually (based on the value of the US$ in 2017). The entire system could be funded with less financial outlay than is incurred by employers and households paying for health-care premiums combined with existing government allocations. This shift to single-payer health care would provide the greatest relief to lower-income households. Furthermore, we estimate that ensuring health-care access for all Americans would save more than 68 000 lives and 1·73 million life-years every year compared with the status quo.

US health system costs four times more to run than Canada’s single-payer system “That spending mismatch, tallied in a study published this week in the Annals of Internal Medicine, could challenge some assumptions about the relative efficiency of public and private health care programs.”

Nick Hanauer (a billionaire) explains why neoloiberal (conservative) economics is wrong

Seattle Times: Judge orders Microsoft to release tax records in IRS dispute (amidst allegations of tax evasion)

How Wealth Reduces Compassion (Wealthy people are less kind.)

Trump administration official resigns, calls for massive student debt forgiveness

Bill Gates calls for income tax in Washington state

Source and full article at The Rich Really Do Pay Lower Taxes Than You

Silicon Valley Owes Us $100 Billion in Taxes (At Least) “Over the past decade, Amazon, Facebook, Microsoft, Netflix, Apple, and Google have been at the cutting edge of corporate tax avoidance.”

From Harper’s Index (Jan 2020): “Average effective tax rate, as a percentage of income, paid by the richest 400 households in the United States in 2018: 23. By the poorest half of American households: 24.” (due to state taxes and to loopholes)

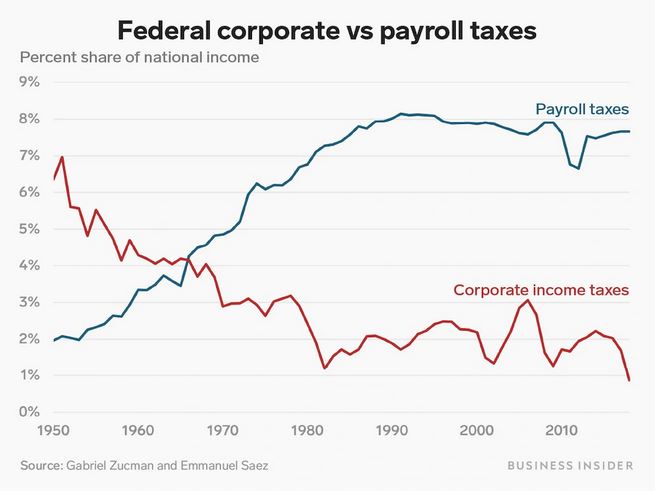

One jarring chart shows how taxes on workers have essentially replaced those on corporations

Finland Is a Capitalist Paradise “Can high taxes be good for business? You bet.”

60 Profitable Fortune 500 Companies Avoided All Federal Income Taxes in 2018

These 8 Men Have As Much Money As Half The World “A new Oxfam report finds income inequality is benefiting a few billionaires who already have “biblical†fortunes.”

The Legacy of the 2001 and 2003 “Bush†Tax Cuts

Evidence suggests that the tax cuts — particularly those for high-income households — did not improve economic growth or pay for themselves, but instead ballooned deficits and debt and contributed to a rise in income inequality.

In fact, the economic expansion that lasted from 2001 to 2007 was weaker than average. A review of economic evidence on the tax cuts by Brookings Institution economist William Gale and Dartmouth professor Andrew Samwick, former chief economist on George W. Bush’s Council of Economic Advisers, found that “a cursory look at growth between 2001 and 2007 (before the onset of the Great Recession) suggests that overall growth rate was … mediocre†and that “there is, in short, no first-order evidence in the aggregate data that these tax cuts generated growth.â€

In comparison, the economic expansion of the early 1990s — which followed considerable tax increases — produced a much faster rate of job growth and somewhat faster GDP growth than the expansion of the early 2000s. An analysis of business activity between 1996 and 2008 found that even the sharp cut in dividend tax rates in 2003, which proponents claimed would spur immediate business growth, had no significant

![]() How Much ‘Inequality Tax’ Are You Paying? If you measure wealth by the median income — that point at which half the nation’s population has more wealth and half less — then Switzerland holds up as a strikingly wealthy nation. The United States does not. Typical Swiss adults turn out to hold $228,000 in net worth, the most in the world. Typical Americans hold personal fortunes worth just $66,000.”

How Much ‘Inequality Tax’ Are You Paying? If you measure wealth by the median income — that point at which half the nation’s population has more wealth and half less — then Switzerland holds up as a strikingly wealthy nation. The United States does not. Typical Swiss adults turn out to hold $228,000 in net worth, the most in the world. Typical Americans hold personal fortunes worth just $66,000.”

Tuition-Free College Could Cost Less Than You Think, about $79 billion a year — which is a small fraction of annual military spending (between $700 billion and $1 trillion, depending on how you measure it).

Salesforce’s Marc Benioff backs higher taxes, renews critique of capitalism

![]() NY Times: The Rich Really Do Pay Lower Taxes Than You (See animation here.)

NY Times: The Rich Really Do Pay Lower Taxes Than You (See animation here.)

![]() 400 Richest U.S. Families Paid Lower Tax Rate Than Working Class, Study Finds

400 Richest U.S. Families Paid Lower Tax Rate Than Working Class, Study Finds

CBS News: America’s richest 400 families now pay a lower tax rate than the middle class

Top Betsy DeVos appointee abruptly quits, calls for canceling $925 billion in student loan debt

‘Just too much’: Meet the uber-rich who want a wealth tax “Chief argument: Government could spend their money more effectively than they could on their own.”

Our Tax System Rewards Polluters “Last year, the biggest fossil fuel companies [including Chevron, Halliburton, and Occidental Petroleum] paid zero dollars in taxes — and actually received billions in rebates.”

The world’s happiest countries are social democracies: Happiest Countries in the World 2019: 1. Finland, 2. Denmark, 3. Norway, 4. Iceland, 5. Netherlands, 6. Switzerland, 7. Sweden, 8. New Zealand, 9. Canada, 10. Australia

‘Eye-Popping’: Analysis Shows Top 1% Gained $21 Trillion in Wealth Since 1989 While Bottom Half Lost $900 Billion “The top one percent owns nearly $30 trillion of assets while the bottom half owns less than nothing.”

Health Insurance Costs Surpass $20,000 Per Year, Hitting a Record

The Big American Bribery Scandal Isn’t Felicity Huffman’s $15,000

Robert Reich: Socialism for the Rich, Capitalism for the Rest “While the wealthy and powerful are coddled with public largesse, the rest of us are thrown into the jaws of an unforgiving economic system.”

https://www.thenation.com/article/bernie-sanders-american-exceptionalism/ Good analysis of the intellectual core of the conservative movement.

Yahoo Finance: Not just Amazon: 60 big companies paid $0 in taxes under Trump law

Big businesses are faring better than ever under the Trump era tax law, the Tax Cuts and Jobs Act (TCJA). According to analysis from the Institute on Taxation and Economic Policy (ITEP), 60 Fortune 500 companies avoided paying all federal income tax in 2018 (with their total average effective tax rate being roughly -5%). That’s more than three times the number of companies that avoided paying corporate taxes on average from 2008 to 2015.

PolitiFact: Bernie Sanders on target saying 3 richest have as much wealth as bottom half of all Americans

A Message From the Billionaire’s Club: Tax Us

Amazon will pay $0 in taxes on $11,200,000,000 in profit for 2018 “According to a report from the Institute on Taxation and Economic Policy (ITEP), Amazon (AMZN) will pay nothing in federal income taxes for the second year in a row.”

Forbes: United States Spend Ten Times More On Fossil Fuel Subsidies Than Education “US spent on these subsidies in 2015 is more than the country’s defense budget and 10 times the federal spending for education.” The Hidden Subsidy of Fossil Fuels “A new report says that the world subsidized fossil fuels by $5.2 trillion in just one year. But that calculation is less tidy than it seems.”

Corporations paid $91 billion less in taxes in 2018 under Trump’s tax law ” In 2018, according to data provided to Yahoo Finance by research firm Oxford Economics, corporations lowered their effective tax rate to just 7% — the lowest since 1947.”

‘Eye-Popping’: Analysis Shows Top 1% Gained $21 Trillion in Wealth Since 1989 While Bottom Half Lost $900 Billion “The top one percent owns nearly $30 trillion of assets while the bottom half owns less than nothing.”

A devastating analysis of the tax cut shows it’s done virtually no economic good

Reaganomics killed America’s middle class

Federal Reserve report finds 1 in 4 adults skip necessary medical care due to cost

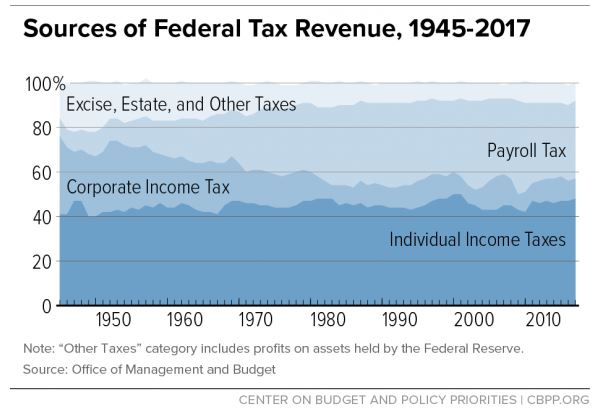

“Amazon—and 56 Other Corporations—Took Your Tax Dollars. Sixty profitable corporations paid no federal taxes in 2018, twice the number that typically paid nothing in the years before the 2017 tax breaks took effect. In fact, it’s worse than that. Fifty-seven of these corporations demanded rebates from the government – which means taxpayers like you and me paid them to exist. These are corporations on the dole. They claim to hate socialism if it means Medicare for All, but they sure as hell love socialism when it’s welfare for them.” ” Last year, individual taxpayers provided more than half of federal income tax revenue and corporations contributed only 7 percent. Just four years ago, corporations accounted for 11 percent and individual taxpayers 47 percent. “ As you can see in the following chart, the percent of revenue coming from Payroll taxes and Individual income taxes has increased, while the percent coming for the Corporate Income Tax has decreased.

Jimmy Carter Took Call About China From Concerned Donald Trump: ‘China Has Not Wasted a Single Penny on War’ Carter says that the U.S. has enjoyed only 16 years free from war in its 242 year history and recently spent $3 trillion on wars, while China has been war-free. No wonder China is overtaking the U.S.

Socialism for the Rich, Capitalism for the Rest “Around 60 percent of America’s wealth is now inherited. Many of today’s super-rich have never done a day’s work in their lives. Trump’s response has been to expand this divide by cutting the estate tax to apply only to estates valued at over $22 million per couple. Mitch McConnell is now proposing that the estate tax be repealed altogether.”

A C.E.O. Who’s Scared for America Capitalism, he says, is slowly committing suicide.

Forbes: Report: The Department Of Education Has Spent $1 Billion On Charter School Waste And Fraud

Charter Schools Are Scamming the U.S. Government

Analysis: Koch Brothers Could Get Up To $1.4 Billion Tax Cut From Law They Helped Pass

Adelson plows $30 million of his $670 million tax windfall back into keeping Congress in GOP hands

The Trump tax law has big problems. Here’s one big reason why

Washington Again Rated Worst For Tax System If You’re Poor In Washington, the poor pay the most in U.S. in taxes. Rich people are getting a way better deal, according to a new study.

According to the nonpartisan Institute on Taxation and Economic Policy, Washington households that earn $24,000 or less per year pay almost 18 percent of their income in taxes.

The top 1 percent, households that earn $549,000 or higher per year, pay just 3 percent of their income in taxes.

GOP Tax Scam leads to U.S. budget deficit 40% higher than last year

Donald Trump nominates man whose firm tripled price of insulin to regulate drug companies

Amazon paid no federal taxes for the second year in a row

Amazon Will Pay a Whopping $0 in Federal Taxes on $11.2 Billion Profits

Those wondering how many zeros Amazon, which is valued at nearly $800 billion, has to pay in federal taxes might be surprised to learn that its check to the IRS will read exactly $0.00.

According to a report published by the Institute on Taxation and Economic (ITEP) policy Wednesday, the e-tail/retail/tech/entertainment/everything giant won’t have to pay a cent in federal taxes for the second year in a row.

This tax-free break comes even though Amazon almost doubled its U.S. profits from $5.6 billion to $11.2 billion between 2017 and 2018.

Why Medicare-for-All would save money

U.S. Companies Are Stashing $2.1 Trillion Overseas to Avoid Taxes

PolitiFact says it’s true: Top hedge fund managers make more than all kindergarten teachers combined

As inequality grows, so does the political influence of the rich Concentrated wealth leads to concentrated power

China imports zero U.S. soybeans in November for first time since trade war started

Taxpayers Will Pay for $12 Billion in Aid to Farmers to Cover Losses Caused by Trump’s Tariffs

Federal Deficit Jumps 17 Percent As Tax Cuts Eat Into Government Revenue

Bolton Threatens to Force Africa to choose between US and China The “West’s†political economies are spent forces, incapable of either keeping up with China’s phenomenal domestic growth — which should be seen as Beijing’s re-assumption of its historical status as the center of the world economy — or of competing with China in what used to be called the Third World. The system is collapsing at its imperial center, the United States, which is incapable of investing in its own crumbling infrastructure. Nor can the US maintain its non-military federal agencies, including the Internal Revenue Service.

Verizon Trims 10,000 Employees Despite Billions in Tax Cuts and Government Favors “Killing net neutrality in particular was supposed to spur both job growth and investment.”

The Golden Age of Rich People Not Paying Their Taxes “An eight-year [Republican-led] campaign to slash the IRS’s budget has left the agency understaffed, hamstrung, and operating with archaic equipment. The result: a hundred-billion-dollar heist.” I have a friend who works as an examiner for the IRS; he said the same thing: they’re woefully understaffed.

Inside the Secretive World of Tax-Avoidance Experts

The Reason Many Ultrarich People Aren’t Satisfied With Their Wealth

Your Property Tax Hikes Are Charity for an Important Protected Minority – The Very Wealthy

I support higher taxes. The billionaire behind national debt clock has had it with Trump

Harley-Davidson is Moving Jobs Offshore Despite Tax Cuts and Subsidies

Amazon paid no US income taxes for 2017

The Great Kansas Tax Cut Experiment Crashes And Burns From Forbes. “After four years of below-average growth, deepening budget deficits, and steep spending reductions, the GOP-dominated Kansas legislature has repealed many of the tax cuts at the heart of Governor Sam Brownback fiscal agenda.”

The 1% grabbed 82% of all wealth created in 2017 From CNN

Billionaires Made So Much Money Last Year They Could End Extreme Poverty Seven Times

(From Time magazine!)

Billionaire Bill Gates Says He Should Pay ‘Significantly Higher’ Taxes

Who Pays? A distributional analysis of the tax systems in all 50 states Washington State’s tax system is the most regressive.

The Billionaire Bonanza: 5 Things You Need To Know About The Inequality Gap

There are now 2,043 dollar billionaires worldwide. Nine out of 10 of them are men.

In 12 months, the wealth of this elite group of 2,043 has increased by $762 billion — enough to end extreme poverty seven times over.

In the period between 2006 and 2015, ordinary workers saw their incomes rise by an average of just 2 percent a year, while billionaire wealth rose by nearly 13 percent.

Bill Gates, Jeff Bezos and Warren Buffett, the three richest people in the U.S., own the same wealth ($248.5 billion) as the bottom half of the U.S. population.

Wall Street bonuses soar 17% to an average of $184,200

Wall Street Bankers’ Average Bonus Jumps to Highest Since 2006

Wisconsin’s Voter-ID Law Suppressed 200,000 Votes in 2016 (Trump Won by 22,748)

Bill Gates: The private sector is completely inept “Since World War II, U.S.-government R&D has defined the state of the art in almost every area.”

Nation’s top 1 percent now have greater wealth than the bottom 90 percent

15,000 scientists issue dire warning that “time is running out” on climate change

The desperate inequality behind global tax dodging

Why have we built a paradise for offshore billionaires?

World’s witnessing a new Gilded Age as billionaires’ wealth swells to $6tn

George Carlin on why America fights wars (first part)

I helped create the GOP tax myth. Trump is wrong: Tax cuts don’t equal growth.

Our Broken Economy, in One Simple Chart

Why drug tests for welfare recipients are a waste of money

I’m an American living in Sweden. Here’s why I came to embrace the higher taxes

In The Horrifying Hidden Story Behind Drug Company Profits and The Truth about the Drug Companies, a former Editor in Chief of the New England Journal of Medicine writes of the drug industry, “Instead of being an engine of innovation, it is a vast marketing machine. Instead of being a free market success story, it lives off government-funded research and monopoly rights.â€

Fighting Back Against the White Revolt of 2016

Pentagon buries evidence of $125 billion in bureaucratic waste

An Exhaustive List of the Allegations Women Have Made Against Donald Trump

Proof You Shouldn’t Blame Teachers For The Achievement Gap

10 Taxpayer Handouts to the Super Rich That Will Make Your Blood Boil

Tax Avoidance On the Rise: It’s Twice the Amount of Social Security and Medicare

http://www.people-press.org/2014/06/12/political-polarization-in-the-american-public/

How U.S. companies are avoiding $695 billion in taxes

The interesting thing that happened when Kansas cut taxes and California hiked them

The 7 Biggest Myths and Lies About Social Security

Confronting the Parasite Economy

Report: 74% Of Billionaire Wealth From Rent-Seeking

Ex-Reagan adviser: Fox News is ‘self-brainwashing’ Republicans into a radical fringe party

About 95 of the 100 poorest counties in America are in Republican states

35 Mind-Blowing Facts About Inequality

The Pentagon Lost $8.5 TRILLION of Taxpayers’ Money

10 Government Handouts That Prove Who The Biggest ‘Takers’ Actually Are

The Rich Hide an Estimated 21 Trillion in Offshore Accounts

They Myth Behind Defensive Gun Ownership

Bernie Sanders Exposes 18 CEOs who took Trillions in Bailouts, Evaded Taxes and Outsourced Jobs

Report: Walmart Workers Cost Taxpayers $6.2 Billion In Public Assistance

Look who doesn’t pay their fair share

CEO pay at Boeing, Ford exceeds companies’ tax bill

Washington State Is Flying Blind in a Storm of Corporate Tax Breaks

Microsoft doesn’t need our tax break

For-profit colleges get harsh grades by former students

Where are Washington’s K-12 dollars? Just ask Microsoft shareholders

The Triggers of Economic Inequality

Another Study Finds Unaccountable Charter Schools Dogged by Corruption

Tax-subsidized Boeing Co. snubs state again

Eight things mainstream media doesn’t have the courage tell you

The Top Five Bank Bailouts We Never Heard About

Pro-Life? GOP Promotes Nine Out Of Ten Things That Cause Death In Unborn Children

Libertarian ‘Utopia’ Styled After Ayn Rand Book Spectacularly Falls Apart Almost Immediately

State-Level Tax Cuts Don’t Boost Job Growth, Study Says

Microsoft’s Staggering Tax Dodge Alone Would Fund the Entire State of Washington for Two Years

Microsoft Admits Keeping $92 Billion Offshore to Avoid Paying $29 Billion in US Taxes

Forbes: Walmart Workers Cost Taxpayers $6.2 Billion In Public Assistance

10 Disgustingly Rich Companies That Will Do Anything To Avoid Paying Taxes

Google Revenues Sheltered in No-Tax Bermuda Soar to $10 Billion

United States Taxpayers Are Subsidizing Walmart

Rep. Grijalva Demands Federal Investigation into ALEC’s Role in Neo-Sagebrush Rebellion

Washington among the states with the best ‘return on investment’

Why Are Republicans Plotting To Sabotage A Crackdown On Tax Evasion?

Koch-backed political coalition, designed to shield donors, raised $400 million in 2012

Graph showing concentration of wealth into the top 0.1%

Add It Up: The Average American Family Pays $6,000 a Year in Subsidies to Big Business

http://benirwin.wordpress.com/2013/12/03/20-things-the-poor-do-every-day/

The state that taxes the poor the most is a blue one (WA State)

The Self-Made Myth: The Truth About How Government Helps Individuals and Businesses Succeed

The 1 percent played Tea Party for suckers

Follow the Trillions (If You Can)

Medicare for all would save billions

Eight Ways Privatization Has Failed America

We’re Taxing the Rich … and So Can You

Rich Entrepreneur: The Wealthy Aren’t Job Creators, Middle-Class Workers Are

What The Founding Fathers Thought About Corporations

Right-Wing Economics vs. Reality

Microsoft could find payoff, take high road by paying up taxes

We’re living in an Ayn Rand economy

The Biggest “Takers” and Societal Parasites Are the Rich, Not the Working Class and Poor

Apple Dodges Enough Taxes to Cover Much of the Sequester

In Blind Poll, Republicans Choose Progressive Budget Solutions Over Their Own Party’s

The U.S. Collects Smaller Percentage In Taxes Than Most Developed Countries: Study

http://reclaimdemocracy.org/corporate-welfare-tax-breaks-subsidies/

If Corporations Don’t Pay Taxes, Why Should You?

F-35’s ability to evade budget cuts illustrates challenge of paring defense spending

Offshore Cash Hoard Expands by $183 Billion at Companies

Silicon Valley firms shelter assets overseas, avoid billions in U.S. taxes

65 Years of Tax Cuts for the Wealthy Created Record ‘Inequality’ Not ‘Prosperity,’ says Report

Romney’s Bain Closes U.S. Plant, Forces Workers to Train Chinese Replacements

10 Most Profitable U.S. Corporations Paid Average Tax Rate Of Just 9 Percent Last Year: Report

The Scam Wall Street Learned From the Mafia

Top US companies shelling out to block action on climate change

Ayn Rand-Loving Right Is Like Teen Boys Gone Crazy

Let’s just say it: The Republicans are the problem.

Six Rigged Rules Corporations Use to Dodge Taxes

Growth of Income Inequality Is Worse Under Obama than Bush

Break Up the Big Banks, Says the Dallas Fed

The Rich Evade Taxes and We End Up Paying Their Share

10 Epic Failures of the Bush Tax Cuts

See a deceptive political ad? Report it!

Obama team sadly misinformed by job outsourcers

How Ayn Rand Seduced Generations of Young Men and Helped Make the U.S. Into a Selfish, Greedy Nation

A rich American destroys the fiction that rich people create jobs

Washington Public Bank Project

Despite Supercommittee Failure, Republicans Intend to Get Their Pound of Flesh in 2012

America’s corporate tax obscenity

Email the 1% — Wall Street executives

Thomas Must Resign, Says Former Judge, Lover

Occupy Wall Street: The Right’s smear machine goes to work

The Occupy protests: A timely call for justice

http://www.opednews.com/articles/Destroying-the-Postal-Serv-by-Chuck-Zlatkin-110905-492.html

North Dakota’s Economic Miracle

Panel tallies massive waste and fraud in wartime U.S. contracts

Why Amazon Can’t Make A Kindle In the USA

Barack Obama: more conservative than Richard Nixon?

Why is the Most Wasteful Government Agency Not Part of the Deficit Discussion?

Sarah Palin: the Sound and the Fury

Infographic: One Day’s Worth of Millionaire Tax Cuts Would Feed Needy Families for a Year

Confidential Federal Audits Accuse Five Biggest Mortgage Firms Of Defrauding Taxpayers

FCC Commissioner Baker’s blatant conflict of interest

Alaska Lawyers Walk out in Protest of John Yoo

The Eleven Craziest Things Newt Gingrich Has Ever Said

Video: Sen. Sanders and Rep. McDermott Introduce Single-Payer Bills

BRICS: Shaking the world order

Alabama’s GOP Delegation Voted Against Funding for Tornado Forecasting

FAIR: Ignoring Trump’s record of racism

Al Jazeera: The African ‘Star Wars’ (on the quest for oil against China)

Rescue America — 4 point plan (Norman Goldman)

AP Pranked Into Printing Fake Story About GE’s “Generosity”

The ‘Judicial Independence’ of Justice David T. Prosser – A BRAD BLOG Special Investigation

The Solution: Close Tax Loopholes

Dumb Bill O’Reilly interviews Richard Dawkins

Mitt Romney Haunted By Past Of Trying To Help Uninsured Sick People

Need help choosing your religion?

Pay Your Taxes? These 10 Companies Didn’t.

Is it that scary and unpopular to close tax loopholes?

The Real Housewives of Wall Street

Washington Conservation Voters legislative scorecard

9 Things The Rich Don’t Want You To Know About Taxes

Justice Department Asks Spain Not to Prosecute U.S. Torturers

Comparing Public and Private Sector Compensation over 20 Years

How Amazon (like Boeing and GE and Microsoft…) avoids paying state sales taxes

Stop WikiLeaks torture (real-time signing)

Lawsuit filed over Basic Health cuts to poor people

To The American Media: Time To Face The Reality Of Election Rigging

Mike Huckabee Says He Wants Americans To Be Indoctrinated At Gunpoint

Bob Fitrakis on Ohio Republicans’ New Jim Crow Voter ID law that Disenfranchises 900,000 Voters

Meet Jim Messina, Obama’s ‘Enforcer’ Against Progressives

Stockman: Bush Tax Cuts Will Make U.S. Bankrupt

Smart ALEC: Dragging the Secretive Conservative Organization Out of the Shadows

Half a Million Protestors on the Streets of London; Silence in the US Media

General Electric: King of the Tax Dodgers

Inside Job: How Goldman Sachs got away with crimes

The Must See Chart (This Is What Class War Looks Like)

Phase-out for Washington’s Biggest Polluter

Koch And Native-American Reservation Oil Theft

Mother grieveing fallen US soldier

Washington’s Environmental Priorities

Obama dodges calls to … stand with unions

More Evidence Wall Street pay at Near Record Levels

Gates Announces Extended U.S. Occupation in Afghanistan

Nation’s top 1 percent now have greater wealth than the bottom 90 percent

Where your income tax money really goes

Tax Rates for Top 400 Earners Fall as Income Soars, IRS Data

What has the Republican Party done for the middle class?

House GOP vote unanimously to protect Big Oil subsidies

Capital Rivals: Koch Brothers vs. George Soros

Clever video: The Story of Citizens United v. FEC (2011)

Corporations don’t have ‘personal privacy’ rights, Supreme Court rules

The DOJ’s creeping war on whistle-blowers

CNN oped: Prosecute Bush for Torture

Texas college kids could soon pack heat

The Forgotten Achievements of Government

Living Greedy: closing WA tax loopholes

Koch Brothers “Prank” No Laughing Matter

Shifting Responsibility: How 50 Years of Tax Cuts Benefited the Wealthiest Americans

Wisconsin Gov. Walker Ginned Up Budget Shortfall To Undercut Worker Rights

Google’s true origin partly lies in CIA and NSA research grants for mass surveillance

“When congressional Republicans passed their so-called tax-reform bill, they preserved the deduction for charitable contributions even as they capped the deduction for state and local tax payments. Thus a hundred-million dollar gift to Harvard will still be fully deductible, while, in many parts of the country, the property taxes paid to support local public schools will not be.” — Elizabeth Kolbert, in The New Yorker, Aug, 27, 2018

Seattle taxes ranked most unfair in Washington — a state among the harshest on the poor nationwide

U.S. companies found ways to avoid taxes before tax cut bill -report “Fifteen U.S. corporations including online retailer Amazon.com Inc, power company Duke Energy Corp and insurer Prudential Financial Inc avoided U.S. tax on nearly $25 billion in combined profits last year, a tax watchdog group said on Tuesday.”